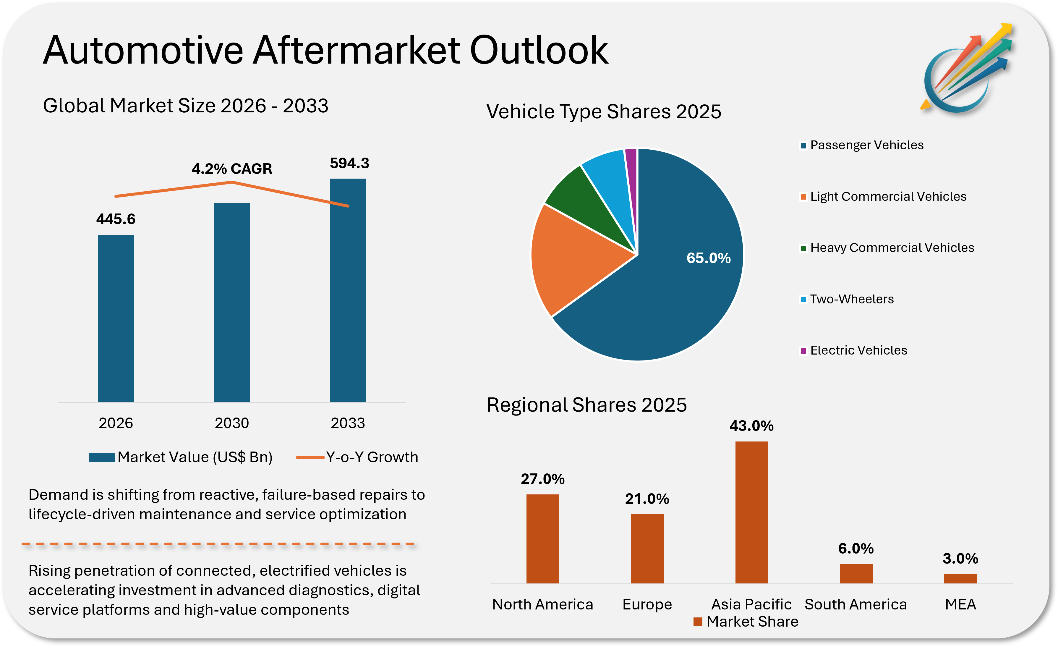

New York, NY, Feb. 09, 2026 (GLOBE NEWSWIRE) -- The global automotive aftermarket is estimated to generate USD 445.6 billion of revenue in 2026 and is projected to create USD 594.3 billion of market by 2033. The market plays a critical role in sustaining global vehicle fleets, encompassing replacement parts, maintenance, repair services, and accessories. Rising vehicle fleet size, vehicle lifespans and increasing average mileage are fueling demand across both mature and emerging markets. The automotive aftermarket is witnessing the convergence of traditional mechanical repairs with tech diagnostics, as independent service providers acquire the capabilities needed to service software-defined vehicles.

The industry is undergoing a gradual transformation driven by connected vehicle technologies, e-commerce penetration and regulatory emphasis on vehicle safety and emissions. Independent service providers and parts distributors are adopting digital diagnostics, predictive maintenance tools as well as omnichannel sales models to bolster their market positions. Automotive aftermarket is repositioning itself toward software-enabled services, high-value components, specialized repair capabilities, strengthening role in the broader automotive ecosystem owing to growth in vehicle electrification.

Request a Sample Report to Explore Key Market Insights: https://marketmindsadvisory.com/automotive-aftermarket-sector/

Key Takeaways from Automotive Aftermarket

- Automotive aftermarket is anticipated to witness an annualised growth rate of 4.2% over the forecast period.

- Replacement parts that is the wear and tear parts including, tires, brakes, filters, etc. remain the prominent revenue contributor.

- Digital & electronic accessories are projected to remain the fastest-growing segment, driven by demand for retrofitting old passenger vehicles with modern infotainment and ADAS features.

- In Asia-Pacific, India and ASEAN are emerging as a key investment market due to expanding vehicle fleet and emergence of the organized sectors.

- Competitive intensity is increasing due to vertical integration, where automakers are launching their own replacement parts to compete on pricing.

- Rising demand for EV battery refurbishment and recycling is creating significant opportunities for specialized market players.

Market Dynamics Shaping the Automotive Aftermarket

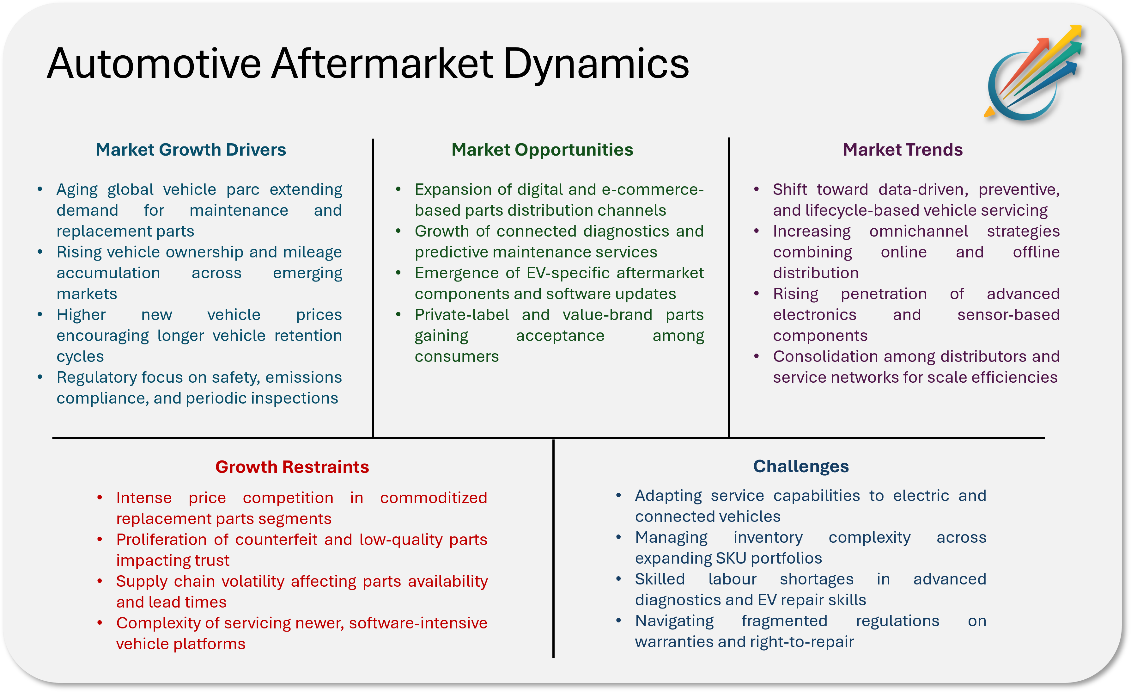

Aging Global Vehicle Fleet Driving the Automotive Aftermarket Demand

Average age of vehicles all over the globe is increasing and is a primary growth driver for automotive aftermarket. Consumers are retaining vehicles longer due to higher pricing of new vehicles and improved vehicle durability. This is increasing demand for replacement parts, routine maintenance and repair services. In both developed and emerging markets, rising mileage accumulation is further accelerating wear-and-tear-related component replacement, supporting consistent aftermarket demand across mechanical and electrical product categories. This aging fleet guarantees demand for suspension, braking, exhaust and other components.

Digitalization and Service Innovation creating lucrative avenues for Automotive Aftermarket

Digital transformation is creating new growth opportunities across the aftermarket value chain. Online parts retailing, connected diagnostics, predictive maintenance platforms are reshaping how consumers and workshops source and service vehicles. Data-driven inventory management and direct-to-consumer models are improving margins and availability. The shift towards electric vehicles is also creating emerging demand for specialized parts, opening new revenue streams for aftermarket participants. Further, increase in the online retail presence is bolstering the automotive aftermarket growth from the supply chain owing to ease of availability of the required parts.

Price Sensitivity and Supply Chain Volatility Restraining Automotive Aftermarket Growth

Price competition remains high owing to presence of substantial number of small and medium size players, especially in commoditized replacement parts segments. Consumers and workshops prioritize cost over brand, pressuring margins for manufacturers and distributors. Supply chain disruptions in recent times, counterfeit parts, fluctuating raw material prices and increase in global trade tensions further complicate inventory planning and profitability. Regulatory differences across regions related to warranties, and quality standards also add compliance complexity, slowing market expansion.

Purchase the Full Market Report with In-Depth Analysis & Forecasts: https://marketmindsadvisory.com/buy-now/?report_id=30310

Automotive Aftermarket Segmentation

By Product Type

- Replacement Parts

- Engine Components

- Transmission & Drivetrain Parts

- Braking Systems

- Steering & Suspension

- Exhaust Systems

- Wear & Tear Parts

- Brake Pads & Discs

- Clutches

- Spark Plugs

- Consumables & Fluids

- Engine Oils & Lubricants

- Transmission Fluids

- Accessories

- Interior Accessories

- Exterior Accessories

Replacement parts accounts for most of the sales in the aftermarket due to recurring maintenance requirements, while consumables such as oils and filters ensure high-volume demand. In terms of value replacement parts accounts for 52% of automotive aftermarket. Accessories and performance parts accounts for a low market share but higher-margin segments, especially in North America.

By Distribution Channel

- Online Channels

- E-Commerce Platforms

- Manufacturer Direct-To-Consumer

- Fleet & B2B Channels

- Dealer Service Networks

- Fleet Service Providers

- Leasing & Rental Company Networks

- Independent Repair Shops

- Auto Parts Retailers

- Multi-Brand Workshops

Offline channels, including authorized dealers and independent workshops, remain dominant in the market and holds a prominent value share. Online platforms is anticipated to remain the fastest-growing sales channel over the forecast period due to convenience, pricing transparency and wider product access. E-commerce segment is also disrupting traditional three-tier distribution models by connecting manufacturers directly to end-users and garages. Omnichannel strategies are being adopted by key players to boost the market position.

By Vehicle Type

- Passenger Vehicles

- Hatchbacks

- Sedans

- SUVs & Crossovers

- Others

- Light Commercial Vehicles

- Pickup Trucks

- Vans

- Heavy Commercial Vehicles

- Trucks

- Buses & Coaches

- Off-Highway Vehicles

- Two-Wheelers

- Electric Vehicles

Passenger vehicles account for 65% of the automotive aftermarket demand owing ti presence of substantial vehicle fleet. Commercial vehicles generate higher per-vehicle aftermarket revenue due to intensive usage, while two-wheelers contribute steady demand in emerging economies especially in India and ASEAN countries. Commercial vehicle is showing resilience, as fleet operators prioritize preventive maintenance to maximize uptime driving B2B contracts.

By Region

- North America

- Europe

- Asia Pacific

- South America

- MEA

Asia-Pacific is the prominent market and is expected to outperform global averages in automotive aftermarket. This is driven by China's massive vehicle parc entering the post-warranty phase and India's shift from unorganized local garages to branded, tech-enabled service chains. North America is a mature market focused on consolidation and high-value electronic repairs, with the right to repair legislative in this region setting the regulatory tone. High demand supported by large aging vehicle base in the United States. Europe maintains stable demand generation in automotive aftermarket driven by regulatory compliance and high service standards.

Get a Custom Research Report with Region or Company-Specific Data: https://marketmindsadvisory.com/request-customization/?report_id=30310

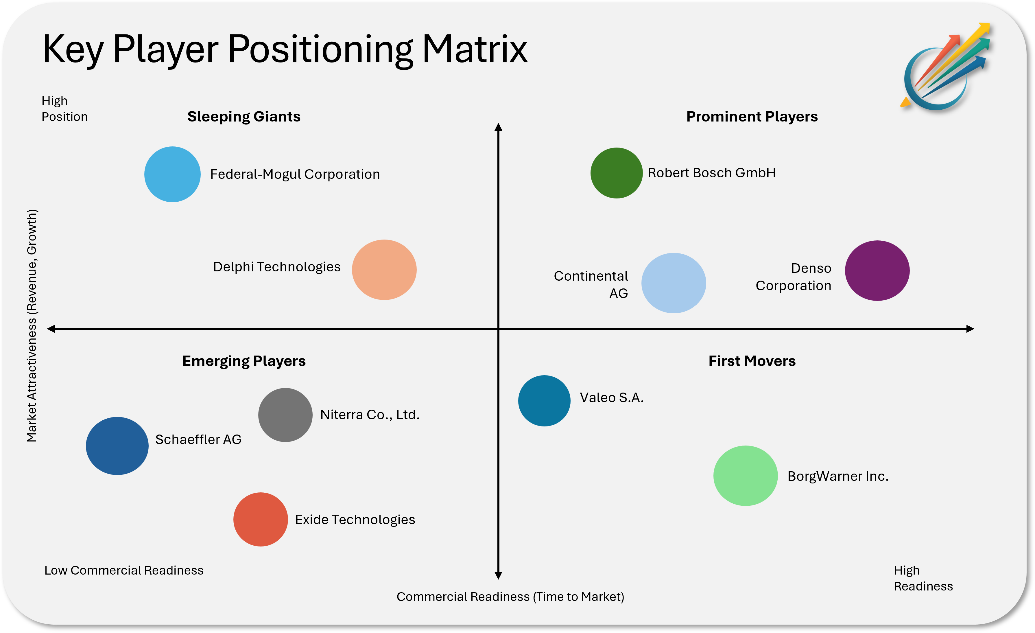

Competitive Landscape – Automotive Aftermarket

Market participants are focusing on private-label expansion, digital distribution and service network partnerships to strengthen market positioning. Ky players are investing to expand their market potion through vertical integration and data-enabled inventory optimization to enhance regional reach and product portfolios.

key distributors are acquiring to build super-networks that guarantee parts availability. Traditional parts suppliers like Bosch and Continental are pivoting to become mobility solutions providers, offering cloud-based diagnostic platforms to independent workshops to ensure their parts remain the default choice in the market.

Key Players in Automotive Aftermarket are

- Robert Bosch GmbH

- Denso Corporation

- ZF Friedrichshafen AG

- Continental AG

- Magna International

- Valeo S.A.

- Aisin Corporation

- BorgWarner Inc.

- Schaeffler AG

- Hella

- Niterra Co., Ltd.

- Bridgestone Corporation

- Michelin

- Goodyear Tire & Rubber Company

- Federal-Mogul Corporation

- Tenneco, Inc.

- Delphi Technologies

- Mahle GmbH

- MANN+HUMMEL

- Exide Technologies

Key Developments:

- In November 2025, Bosch expanded its Bosch Car Service network in Southeast Asia, digitizing over 2,000 workshops to handle EV maintenance and software updates.

- In July 2025, ZF Friedrichshafen partnered with Verizon Connect to create a closed-loop system where real-time fleet data automatically triggers parts ordering and service alerts.

- In August 2024, Continental AG launched a new line of "Smart" air suspension systems for the aftermarket, previously available only as OEM, signalling a move to bring high-tech features to older cars.

- In 2024, AutoZone announced a strategic pivot to "Mega-Hubs", massive distribution centres designed to increase the availability of slow-moving parts, directly countering supply chain volatility.

- In 2024, Delphi expanded its product offerings launching more than 2,000 new parts, covering more than 600 million vehicles all over the globe.

Read the Complete Research Report: https://marketmindsadvisory.com/automotive-aftermarket-sector/

Trending Related Reports:

The Automotive Repair & Maintenance Services Market is projected to achieve remarkable growth, reaching an estimated valuation of USD 916.88 billion in 2025, up from USD 1,851 billion by 2035, expanding at an impressive CAGR of 8.2%.

The global EV Charger Market is expected to expand from USD 7,520.9 million in 2024 to USD 69,967.2 million by 2034, growing at a robust CAGR of 27.6% during the forecast period.

The Automotive Tires Market is projected to grow significantly, reaching a valuation of USD 504.9 billion in 2025 and expanding further to USD 959.8 billion by 2035. This growth represents a CAGR of 7.3% during the forecast period.

The Automotive Battery Management System Market is expected to experience unprecedented growth due to the rapid adoption of electric vehicles (EVs) and hybrid electric vehicles (HEVs), alongside advancements in battery technology.

The global Automotive Die-Casting Lubricants Market is set to experience substantial growth, driven by advancements in die-casting technology, increasing demand for lightweight vehicles, and stringent environmental regulations.

The Automotive Electronics Market is projected to grow from USD 250.65 billion in 2025 to USD 392.43 billion by 2035, expanding at a CAGR of 5.6%.

The global automated material handling system market is estimated to be valued at around USD 40.6 billion in 2026 and under current investment, technology adoption and policy trajectories, annual sales is projected to cross USD 72.4 billion by 2033, registering a CAGR of 8.6%.

The global Automotive Refinish Coating Market is poised for substantial growth, driven by rising vehicle ownership, technological advancements, and increasing demand for customized aesthetics.

The global Automotive Appearance Chemical Market is set to witness robust growth in the coming decade, driven by innovation, rising consumer awareness, and expanding automotive ownership worldwide.

The global Automotive Coolant Aftermarket is expected to grow significantly, reaching a valuation of USD 1 billion in 2025 and expanding to USD 1.5 billion by 2035, at a steady CAGR of 5%.

Why choose Market Minds Advisory

Market Minds Advisory delivers decision-grade intelligence trusted by executives across machinery & equipment, packaging, chemical, automotive, information & communication technology, food & beverage, consumer goods, healthcare and other industries. We provide market expansion strategies, go-to-market strategies, market share acceleration, brand positioning analysis, and account enablement and growth. Our forecasting methodology integrates primary interviews, proprietary demand models and continuous market validation to ensure accuracy in volatile and emerging industries. With over 10 years of industry experience and insights derived from primary interviews with several industry stakeholders, our research provides actionable insights and white space analysis for the emerging segments providing the opportunity gaps in the market accounting recent market developments and geopolitical risks. We believe in unlocking growth by helping businesses to see the future of their markets.

Contact Us

Market Minds Advisory

86 Great Portland Street, Mayfair, London,

W1W 7FG, England, United Kingdom

T: +44 020 3807 7725

Email: sales@marketmindsadvisory.com

Website: https://marketmindsadvisory.com/

LinkedIn | Facebook | Twitter | Instagram

Attachments

- Automotive Aftermarket Outlook

- Automotive Aftermarket Dynamics

- Automotive Aftermarket - Key Player Positioning

Market Minds Advisory 86 Great Portland Street, Mayfair, London, W1W 7FG, England, United Kingdom T: +44 020 3807 7725