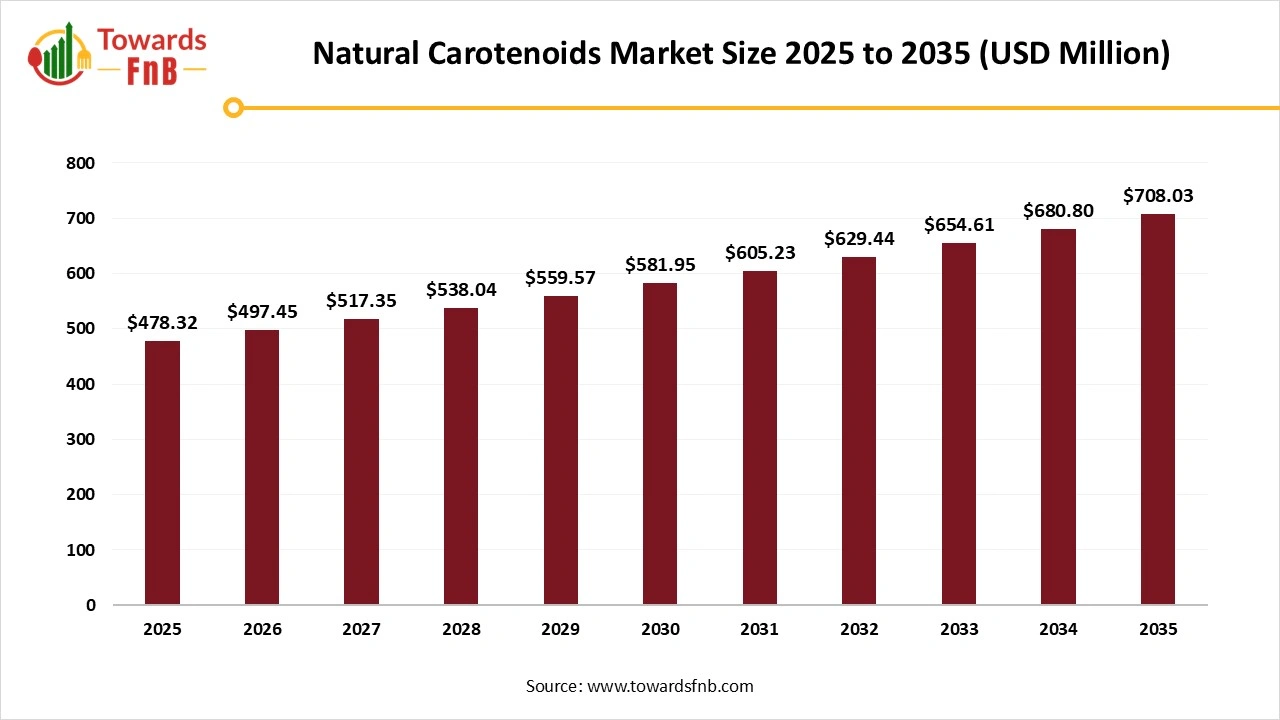

Ottawa, Jan. 27, 2026 (GLOBE NEWSWIRE) -- The global natural carotenoids market size was valued at USD 478.32 million in 2025 and is predicted to grow from USD 497.45 million in 2026 to reach around USD 708.03 million by 2035, as reported by Towards FnB, a sister firm of Precedence Research. As manufacturers invest in sustainable sourcing and advanced extraction technologies, natural carotenoids are gaining stronger penetration in global ingredient supply chains.

The market is expected to grow due to the varied applications of the product, including the cosmetic industry, animal feed, food and beverages, and dietary supplements, which further fuel the market's growth.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Access the Full Study Instantly | Download Sample Pages of the Report Now@ https://www.towardsfnb.com/download-sample/5991

Key Highlights of the Natural Carotenoids Market

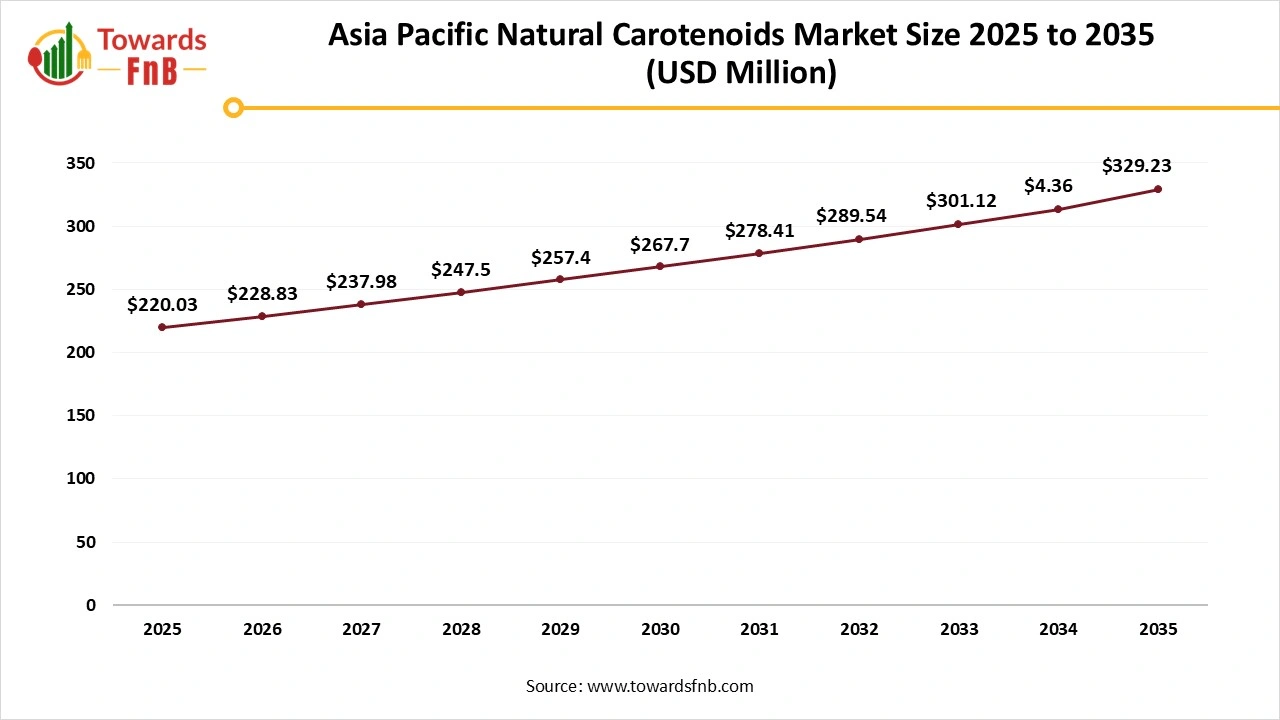

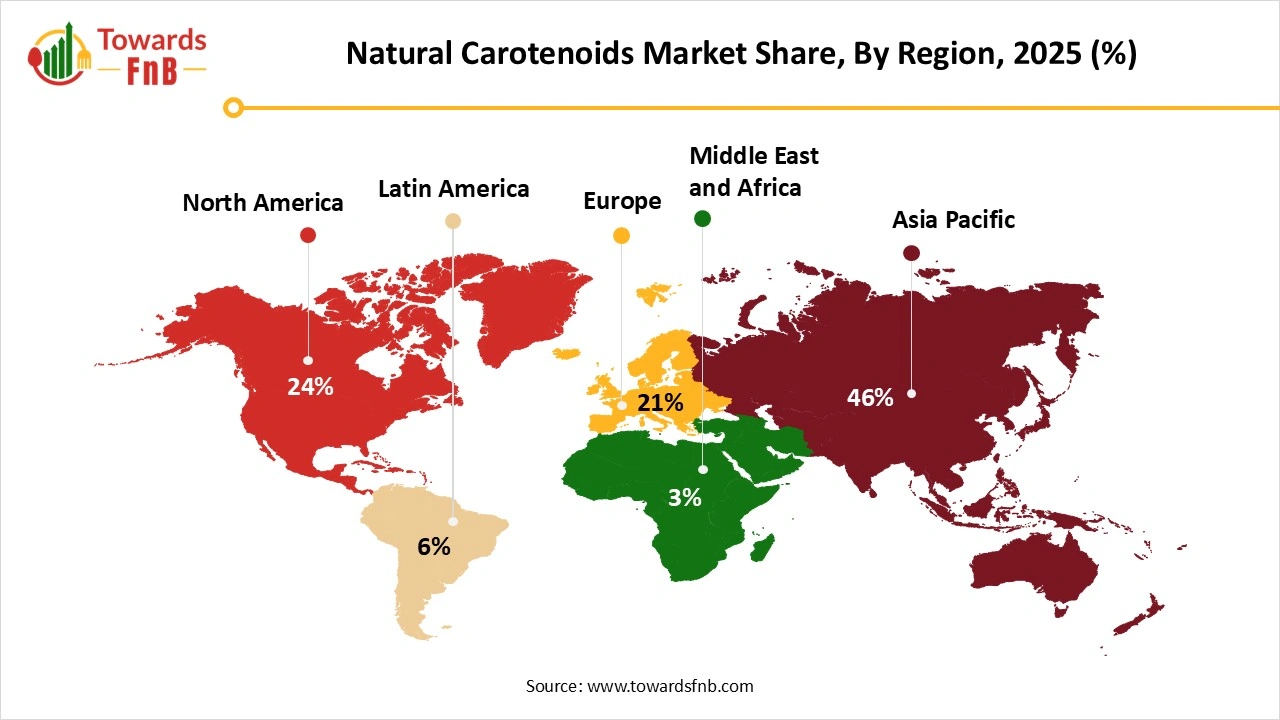

- By region, Asia Pacific dominated the natural carotenoids market in 2025, accounting for approximately 46% of the total share, while North America is expected to register the fastest growth during the forecast period.

- By type, the beta-carotene segment held a major market share of around 35% in 2025, whereas the others segment (including capsanthin, fucoxanthin, etc.) is projected to grow at a CAGR during 2026–2035.

- By source, the algae and microalgae segment led the market with approximately 40% of revenue in 2025, while the plant extracts (flowers & seeds) segment is expected to grow at a CAGR over the forecast period.

- By application, the food and beverage segment dominated the market with about 42% revenue share in 2025, whereas the functional food and beverages segment is projected to grow at a CAGR during 2026–2035.

“Natural carotenoids are transitioning from optional colorants to essential functional ingredients,” said Vidyesh Swar, Principal Consultant at Towards FnB. “Regulatory pressure on synthetic additives, combined with rising consumer demand for natural nutrition and advances in algae-based production, is accelerating adoption across multiple industries.”

Higher Demand for Healthier Options is fueling the Growth of the Natural Carotenoids Industry

The natural carotenoids market is observed to grow significantly due to higher demand for clean-label ingredients and healthier alternatives to enhance the nutritional profile of any product. The market is also observed to grow due to higher demand for natural beta-carotenoids to enhance the taste, nutritional profile, and health quotient of any product, further propelling the growth of the industry.

The market also focuses on beta carotenoids produced with the help of natural sources such as algae, bacteria, and fungi, which are highly demanded by manufacturers to maintain the sustainability and purity of a product. They are also highly demanded for their antioxidant properties, which are further helpful for the growth of the market.

Technological Advancements are helpful for the Growth of the Market

Technological advancements helpful to improve the bioavailability of the product for cost-effective and sustainable production are one of the major factors for the growth of the market. Technological advancements also help to enhance delivery and stability, greener extraction, and maintain stability via encapsulation, further fueling the growth of the market.

Impact of AI on the Natural Carotenoids Market

Artificial intelligence is increasingly being applied across the global natural carotenoids market to improve strain selection, extraction efficiency, color consistency, and stability management for applications spanning food and beverages, dietary supplements, animal feed, and cosmetics. Machine learning models analyze large datasets covering botanical sources, microalgae strains, fermentation yields, and environmental growth conditions to predict carotenoid concentration, isomer composition, and color strength, enabling more reliable sourcing across regions with variable climate and agricultural inputs. In production, AI supports optimization of cultivation, harvesting, and extraction processes by modeling parameters such as light exposure, nutrient supply, solvent selection, and thermal sensitivity, which is critical for preserving bioactivity and minimizing degradation of compounds such as beta-carotene, lutein, astaxanthin, and lycopene.

AI-driven process control systems are also used to stabilize downstream operations, including drying, encapsulation, and formulation, helping manufacturers manage oxidation risk, color drift, and shelf-life variability during long-distance storage and international distribution. From a quality and regulatory perspective, AI assists in compositional standardization, contaminant risk screening, and specification alignment by mapping product attributes against international food safety, feed additives, and labeling frameworks referenced by the Food and Agriculture Organization and the Codex Alimentarius Commission.

View Full Market Intelligence@ https://www.towardsfnb.com/insights/natural-carotenoids-market

Recent Developments in the Natural Carotenoids Market

- In July 2025, Prodalim, a well-renowned name in the juice and specialty ingredients segment, announced the launch of its coloring foodstuffs and natural colors portfolio.

New Trends of Natural Carotenoids Market

- Higher demand for clean label and natural ingredients is one of the major factors for the growth of the market.

- Growing awareness about the benefits of beta carotenoids in the food and beverage industry, along with other domains, is another vital factor propelling the growth of the market.

- Higher demand for natural carotenoids in the aquaculture and animal feed manufacturing industry for improved quality also helps to elevate the industry’s growth.

Product Survey of the Natural Carotenoids Market

| Product Category | Description or Function | Common Forms or Variants | Key Applications or User Segments | Representative Brands or Product Types |

| Beta-Carotene | Provitamin A carotenoid used for coloring and nutritional fortification | Oil suspensions, beadlets, powders | Beverages, dairy products, dietary supplements | Natural beta-carotene ingredients |

| Lutein | Xanthophyll carotenoid supporting eye health and natural coloration | Oil suspensions, encapsulated powders | Dietary supplements, functional foods | Marigold-derived lutein |

| Zeaxanthin | Carotenoid often paired with lutein for eye health formulations | Oil dispersions, beadlets | Nutritional supplements, fortified foods | Natural zeaxanthin extracts |

| Lycopene | Red carotenoid with antioxidant properties | Oleoresins, beadlets, powders | Supplements, beverages, functional foods | Tomato-derived lycopene |

| Astaxanthin | Potent antioxidant carotenoid sourced from microalgae or yeast | Oil extracts, softgel-grade powders | Dietary supplements, aquaculture feed | Natural astaxanthin ingredients |

| Canthaxanthin | Red-orange carotenoid used for pigmentation | Oil-based and dry formulations | Food coloring, feed applications | Natural canthaxanthin products |

| Paprika Oleoresin | Carotenoid-rich extract providing red-orange color | Oil-soluble oleoresins | Processed foods, seasonings | Paprika-derived color systems |

| Annatto Extracts | Natural carotenoid-based colorant derived from annatto seeds | Oil-soluble and water-dispersible forms | Dairy products, snacks, bakery | Annatto color ingredients |

| Mixed Carotenoid Blends | Blends formulated for stability, color shade, or nutrition | Multi-carotenoid beadlets or powders | Functional foods, supplements | Carotenoid blend systems |

| Encapsulated Carotenoids | Carotenoids protected for stability and controlled release | Spray-dried, microencapsulated forms | Beverages, supplements, fortified foods | Encapsulated carotenoid ingredients |

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5991

Natural Carotenoids Market Dynamics

What Are the Growth Drivers of the Natural Carotenoids Market?

Higher demand for natural and clean-label ingredients and options made from them is one of the major factors for the growth of the market. The growing health and wellness trends, followed by the growing health-conscious population, are another major factor fueling the growth of the natural carotenoids industry. The market is also observed to grow due to higher usage of beta carotenoids as natural additives and color, further fueling the growth of the market. The ingredient is also useful for the manufacturing of different types of makeup options due to its antioxidant property, further fueling the growth of the market.

Supply Chain Issue Hampering the Growth of the Natural Carotenoids Market

Higher costs of crops due to harsh climatic issues, geopolitical issues, pests, and various similar issues are some of the major restrictions in the growth of the market. Higher prices and shortages of raw materials affecting the price of the final product is another major issue in the growth of the market. Hence, such factors altogether hamper the growth of the market.

Higher Demand for Fortified Options Is Fueling the Growth of the Natural Carotenoids Industry

Higher demand for functional and fortified options is one of the major factors for the growth of the market. Such natural and organic options, helpful to enhance the taste, appearance, and flavors of food and beverages, are one of the major opportunities for the growth of the market. The market also observes growth due to the growing population of health-conscious consumers always in search of such options, further fueling the growth of the market.

Natural Carotenoids Market Regional Analysis

Asia Pacific Led the Natural Carotenoids Market in 2025

Asia Pacific dominated the natural carotenoids market in 2025, due to factors such as growing disposable income, rapid urbanization, growing aquaculture, and growing food and beverage options, further fueling the growth of the market. The market also observes growth due to higher demand for functional and nutraceutical options made from natural ingredients, which is further helpful for the growth of the market. India has made a major contribution to the growth of the market due to higher demand for clean-label ingredients, natural and organic options, and higher demand for functional and fortified options.

North America Is Observed to Be the Fastest-Growing Region in the Foreseen Period

North America is observed to be the fastest-growing region in the foreseen period due to higher demand for natural alternatives in the manufacturing of food and beverages, animal feed, and support various health benefits, such as enhancing immunity, which is helpful for the growth of the market. The US has made a major contribution to the growth of the market due to higher demand for clean-label ingredients and natural additives to enhance various health functions, fueling the growth of the market.

Europe Is Observed to Have a Notable Growth in the Foreseen Period

Europe is observed to have a notable growth in the foreseen period due to supportive government policies and regulatory frameworks, fueling the growth of the market. Higher demand for nutraceuticals and health supplements, along with higher demand for clean-label ingredients and fortified options enriched with vitamins and minerals, is another major factor fueling the growth of the market. Germany has made a major contribution to the growth of the market due to higher demand for clean label ingredients, organic animal feed, and functional and fortified options, further fueling the growth of the market in the foreseeable period.

Trade Analysis for the Natural Carotenoids Market

What Is Actually Traded (Product Forms and HS Proxies)

- Natural carotenoid concentrates (such as β-carotene and mixed carotenoids derived from algae, marigold, or other botanical sources) are commonly traded under HS 29362100 (provitamins and vitamins; natural mixed carotenoids), which captures carotenoid extracts used as ingredients in food, nutraceutical, and cosmetic products. (Primary HS classification used in global trade)

- Carotenoid-rich oil suspensions or concentrated carotenoid oil products are often declared under HS 32030020 (coloring matter of vegetable or animal origin) since they are used as natural pigments in food and animal feed and reported in export data under this heading. (Common classification in customs records)

- Carotenoid powder preparations and natural pigment concentrates used in food coloring, dietary supplements, and functional foods may be traded under related HS subheadings like 29369000 for organic chemical carotenoid mixtures or 21069099 when blended into food preparations. (Alternate customs classification practice)

- Carotenoid-rich botanical extracts destined for dietary supplements are sometimes coded under HS 3004 (medicaments or nutritional preparations) when supplied in capsule or tablet form, reflecting downstream product formats rather than raw ingredients. (Observed in trade descriptions)

- Pigment products based on carotenoids (including natural lycopene and other colorants) may also appear under HS 32041800 (carotenoid dyes and related coloring matter) due to overlapping pigment uses in food, cosmetics, and animal feed applications. (Wider HS classification data)

Top Exporters (Supply Hubs)

- China: Major exporter of natural carotenoid extracts and concentrates, especially mixed carotenoids and β-carotene derivatives, supplying food, supplement, and cosmetic industries in multiple markets. (Export data usage for related HS codes shows extensive trade flows.)

- India: Exporter of mixed carotenoids and botanical carotenoid extracts with shipments to Europe and Asia, reflected in customs records for HS 29369000 products. (Historical export data indicates diverse destination markets.)

- European Union producers (e.g., Netherlands, Germany): Export hubs for value-added carotenoid ingredients and pigment products used in food and animal feed formulations, supported by integrated ingredient manufacturing clusters. (General trade pattern inference for carotenoid derivatives)

- United States: Supplier of high-purity natural carotenoid ingredients and branded concentrates into nutraceutical and food ingredient supply chains. (Observed in import/export listings for carotenoid HS categories)

Top Importers (Demand Centres)

- European Union: Major importer of natural carotenoid concentrates and oil suspensions for use in food coloring, beverages, dietary supplements, and animal feed applications. (EU trade volumes in colouring matter and carotenoid derivatives support strong import activity.)

- United States: Large importer of natural carotenoid ingredients for the dietary supplement and functional food sectors, driven by end-market demand for clean-label antioxidants and pigmented ingredients. (Customs classification data for carotenoid dyes shows significant import presence.)

- Japan: Imports natural carotenoid extracts for use in pharmaceuticals, cosmetics, and nutraceutical products, reflecting strong demand for high-quality ingredient inputs. (Import trends implied by global HS usage patterns)

- South Korea: Growing importer of carotenoid pigment preparations and extract ingredients for functional foods and cosmetic formulations, linked to rising consumer emphasis on natural ingredients. (Global procurement trends for HS carotenoid categories)

Typical Trade Flows and Logistics Patterns

- Bulk shipments of raw carotenoid concentrates and oil suspensions are shipped via containerized sea freight from producing regions (Asia, Europe, and North America) to major demand centers worldwide.

- Powdered carotenoid derivatives with higher value density may be shipped by air freight or consolidated in smaller sea-freight consignments to maintain quality and shelf life.

- Regional distribution hubs handle repackaging, compliance labeling (e.g., food-grade, supplement-grade), and storage prior to delivery to food manufacturers, supplement brands, and feed producers.

- Seasonal crop cycles and botanical harvests influence export timing, particularly for plant-derived carotenoids like lutein from marigold sources.

Trade Drivers and Structural Factors

- Increasing demand for natural colorants and antioxidants in food, beverage, cosmetic, and dietary supplement markets supports sustained import demand for carotenoid ingredients.

- Clean-label and natural ingredient trends encourage formulators to prioritize natural carotenoid extracts over synthetic alternatives.

- Functional food and nutraceutical growth boosts global trade flows of high-purity carotenoid concentrates for antioxidant and eye-health applications.

- Animal feed pigmentation requirements (e.g., poultry and aquaculture) stimulate consistent demand for carotenoid pigment imports.

- Regulatory acceptance of natural additives in key markets shapes sourcing strategies toward verified natural carotenoid producers.

Regulatory, Quality, and Market-Access Considerations

- Natural carotenoid products must comply with food safety, additive, and labeling regulations in importing countries, including permitted use levels and purity standards for food, supplement, and cosmetic applications.

- HS classification choice (e.g., 29362100 vs 32030020 vs 32041800) significantly affects tariff treatment, duty rates, and documentation required for customs clearance.

- Registration or notification as a nutritional ingredient or color additive may be required in some markets prior to import.

- Quality certification (e.g., GRAS, organic, ISO) enhances market access, particularly for food and dietary supplement uses.

Government Initiatives and Public-Policy Influences

- National food safety modernization and ingredient approval frameworks influence trade eligibility and the timeline for novel carotenoid extracts.

- Policies that promote natural and clean-label ingredients can indirectly stimulate import demand for natural carotenoids in processed food and supplement sectors.

- Trade facilitation agreements and tariff harmonization measures affect costs and procedural ease for cross-border movement of carotenoid ingredients.

Natural Carotenoids Market Report Scope

| Report Attribute | Key Statistics |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Growth Rate from 2026 to 2035 | CAGR of 4% |

| Market Size in 2026 | USD 497.45 Million |

| Market Size in 2027 | USD 517.35 Million |

| Market Size in 2030 | USD 581.95 Million |

| Market Size by 2035 | USD 708.03 Million |

| Dominated Region | Asia Pacific |

| Fastest Growing Region | North America |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Have Questions? Let’s Talk—Schedule a Meeting with Our Insights Team: https://www.towardsfnb.com/schedule-meeting

Natural Carotenoids Market Segmental Analysis

Type Analysis

The beta-carotene segment led the natural carotenoids market in 2025, due to higher demand for natural food colors options to make the edible items attractive naturally without using any chemical colors. Higher demand for natural options to avoid different types of lifestyle-related health issues, vision problems, digestive disorders, and immunity problems is another major factor fueling the growth of the market. Higher demand for options helpful to support immunity, strength, and improved health conditions is another major factor helpful for the growth of the market. Higher demand for natural supplements, helpful to enhance the nutritional profile, is also a major factor boosting the growth of the segment. The market also observes growth due to higher demand for natural sources of beta carotenoids, such as sweet potatoes, carrots, and algae.

The other segment is expected to grow in the foreseen period due to higher demand for specialty carotenoids such as fucoxanthin and capsanthin, due to their multiple benefits helpful for the growth of the market. Such carotenoids have multiple health benefits and are rich in antioxidants. Higher demand for functional and natural ingredients in cosmetics, food and beverages, pharmaceuticals, nutraceuticals, and health supplements due to the growing population of health-conscious consumers is another major factor for the growth of the natural carotenoids market in the foreseeable period.

Source Analysis

The algae/microalgae segment led the natural carotenoids market in 2025, due to its high-value pigments such as beta-carotene and astaxanthin. The segment also acts as a natural and sustainable cell factory, further fueling the growth of the market. They source high-demand and natural carotenoids, fueling further health benefits along with the growth of the market. Higher demand for factors such as sustainability, scalability, diverse product portfolios, rising technological advancements, and rising health consciousness are also some of the major factors propelling the growth of the market.

The plant extracts/flowers and seeds segment is observed to grow in the foreseen period due to higher demand for clean-label and natural ingredients in various domains, due to the growing population of the health-conscious crowd. Higher demand for natural and organic alternatives in various industries, such as the pharmaceutical industry, health and wellness, the growing food and beverage industry, and various other industries, will help fuel the growth of the market. Technological advancements in the extraction methods and regulatory support from the government are other major factors fueling the growth of the market.

Application Analysis

The food and beverage segment led the natural carotenoids market in 2025, due to the growing food and beverage industry, which is supported by the growing population and is one of the major factors for the growth of the market. Use of beta carotene and other natural remedies to add attractive hues to food and beverage options is another major factor for the growth of the market. Higher demand for options that help to enhance the colors and appearance of various food and beverage options, along with enhancing their nutritional profile, also helps to fuel the growth of the market. It is highly utilized in options such as cheese, margarine, smoothie, and beverages to make them attractive as well as nutrition-packed to fuel the market’s growth.

The functional food and beverages segment is expected to grow in the foreseen period due to the growing population of health-conscious consumers, fueling the growth of the market in the foreseen period. Higher demand for clean-label options and sustainable options with higher bioavailability is another vital factor for the market’s growth. Higher demand for natural additives supporting different health aspects, such as enhanced vision, improved gut health, and supportive innovative function, also helps to fuel the growth of the market in the foreseeable period.

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Additional Topics Worth Exploring:

- Tea Market: The global tea market size is projected to expand from USD 30.25 billion in 2025 to USD 54.68 billion by 2034, growing at a CAGR of 6.8% during the forecast period from 2025 to 2034.

- Gluten Free Food Market: The global gluten free food market size is increasing from USD 15.71 billion in 2026 and is expected to surpass USD 37.04 billion by 2035, with a projected CAGR of 10% during the forecast period from 2026 to 2035.

- Organic Food Market: The global organic food market size is expected to grow from USD 253.96 billion in 2025 to USD 660.25 billion by 2034, with a compound annual growth rate (CAGR) of 11.20% during the forecast period from 2025 to 2034.

- Canned Food Market: The global canned food market size is projected to expand from USD 144.43 billion in 2026 to reach around USD 218.37 billion by 2035, growing at a CAGR of 4.7% during the forecast period from 2026 to 2035.

- Canned Wines Market: The global canned wines market size is expected to increase from USD 142.20 million in 2026 to reach around USD 369.70 million by 2035, growing at a CAGR of 11.2% throughout the forecast period from 2026 to 2035.

- Plant-based Protein Market: The global plant-based protein market size is forecasted to expand from USD 22.10 billion in 2026 and is expected to reach USD 46.82 billion by 2035, growing at a CAGR of 8.7% during the forecast period from 2026 to 2035.

- Frozen Food Market: The global frozen food market size is expected to grow from USD 473.40 billion in 2026 to reach around USD 721.91 billion by 2035, at a CAGR of 4.8% over the forecast period from 2025 to 2034.

- Beverage Packaging Market: The global beverage packaging market size is projected to reach USD 285.66 billion by 2035, growing from USD 182.57 billion in 2026, at a CAGR of 5.1% during the forecast period from 2026 to 2035.

- Vegan Food Market: The global vegan food market size is evaluated at USD 24.77 billion in 2026 and is expected to reach USD 61.85 billion by 2034, with a CAGR of 10.7% during the forecast period from 2025 to 2034.

- Food Additives Market: The global food additives market size is rising from USD 128.14 billion in 2025 to USD 214.66 billion by 2034. This projected expansion reflects a CAGR of 5.9% throughout the forecast period from 2025 to 2034.

- Coconut Products Market: The global coconut products market size is expected to climb from USD 14.18 billion in 2025 to approximately USD 33.71 billion by 2034, growing at a CAGR of 10.1% during the forecast from 2025 to 2034.

Top Companies in the Natural Carotenoids Market

- BASF SE

- Chr. Hansen A/S

- Cognis GmbH

- Lonza Group AG

- Kerry Group PLC

- Glanbia Nutritionals

- DDW, The Color House

- § DIC Corporation

- LycoRed Ltd.

- Wuhan Yuancheng Technology Co., Ltd.

- Algatech Ltd.

- AstaReal AB

- Natural Alternatives International (NAI)

- Haematococcus Life Science Co., Ltd.

- Cyanotech Corporation

- Interhealth Nutraceuticals

- Zhejiang Medicine Co., Ltd.

- Xinjiang Natural Carotenoids Co., Ltd.

Segments Covered in the Report

By Type

- Beta-Carotene

- Astaxanthin

- Lutein

- Lycopene

- Zeaxanthin

- Canthaxanthin

- Others (Capsanthin, Fucoxanthin, etc.)

By Source

- Algae / Microalgae

- Fruits & Vegetables

- Fungi & Yeast

- Animal-derived (e.g., crustaceans)

- Plant Extracts / Flowers & Seeds

By Application

- Food & Beverages

- Dietary Supplements & Nutraceuticals

- Pharmaceuticals

- Cosmetics & Personal Care

- Animal Feed & Aquaculture

- Functional Foods & Beverages

By Region

North America

- U.S.

- Canada

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

Latin America

- Brazil

- Mexico

- Argentina

Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Thank you for exploring our insights. For more targeted information, customized chapter-wise sections and region-specific editions such as North America, Europe, or Asia Pacific—are also available upon request.

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5991

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Unlock expert insights, custom research, and premium support with the Towards FnB Annual Membership. For USD 495/month (billed annually), get full access to exclusive F&B market data and personalized guidance. It’s your strategic edge in the food and beverage industry: https://www.towardsfnb.com/get-an-annual-membership

About Us

Towards FnB is a global consulting firm specializing in the food and beverage industry, providing innovative solutions and expert guidance to elevate businesses. With an in-depth understanding of the dynamic F&B sector, we deliver customized market analysis and strategic insights. Our team of seasoned professionals is committed to empowering clients with the knowledge needed to make informed decisions, ensuring they stay ahead of market trends. Partner with us as we redefine success in the rapidly evolving food and beverage landscape, and together, we’ll navigate this transformative journey.

Web: https://www.towardsfnb.com/

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Chemical and Materials| Nova One Advisor | Food Beverage Strategies | FnB Market Pulse | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

For Latest Update Follow Us:

Discover More Market Trends and Insights from Towards FnB:

➡️Beverage Flavors Market: https://www.towardsfnb.com/insights/beverage-flavors-market

➡️Salt Market: https://www.towardsfnb.com/insights/salt-market

➡️Probiotic Food Market: https://www.towardsfnb.com/insights/probiotic-food-market

➡️Protein Bar Market: https://www.towardsfnb.com/insights/protein-bar-market

➡️Gluten-Free Bakery Market: https://www.towardsfnb.com/insights/gluten-free-bakery-market

➡️Europe Nutraceuticals Market: https://www.towardsfnb.com/insights/europe-nutraceuticals-market

➡️Canned Food Market: https://ww w.towardsfnb.com/insights/canned-food-market

➡️Non-Alcoholic Beverages Market: https://www.towardsfnb.com/insights/non-alcoholic-beverages-market

➡️Dry Fruit Market: https://www.towardsfnb.com/insights/dry-fruit-market

➡️Frozen Meat Market: https://www.towardsfnb.com/insights/frozen-meat-market

➡️Fish Oil Market: https://www.towardsfnb.com/insights/fish-oil-market

➡️Soft Drink Concentrates Market: https://www.towardsfnb.com/insights/soft-drink-concentrates-market

➡️Meal Kits Market: https://www.towardsfnb.com/insights/meal-kits-market

➡️Ethnic Food Market: https://www.towardsfnb.com/insights/ethnic-food-market