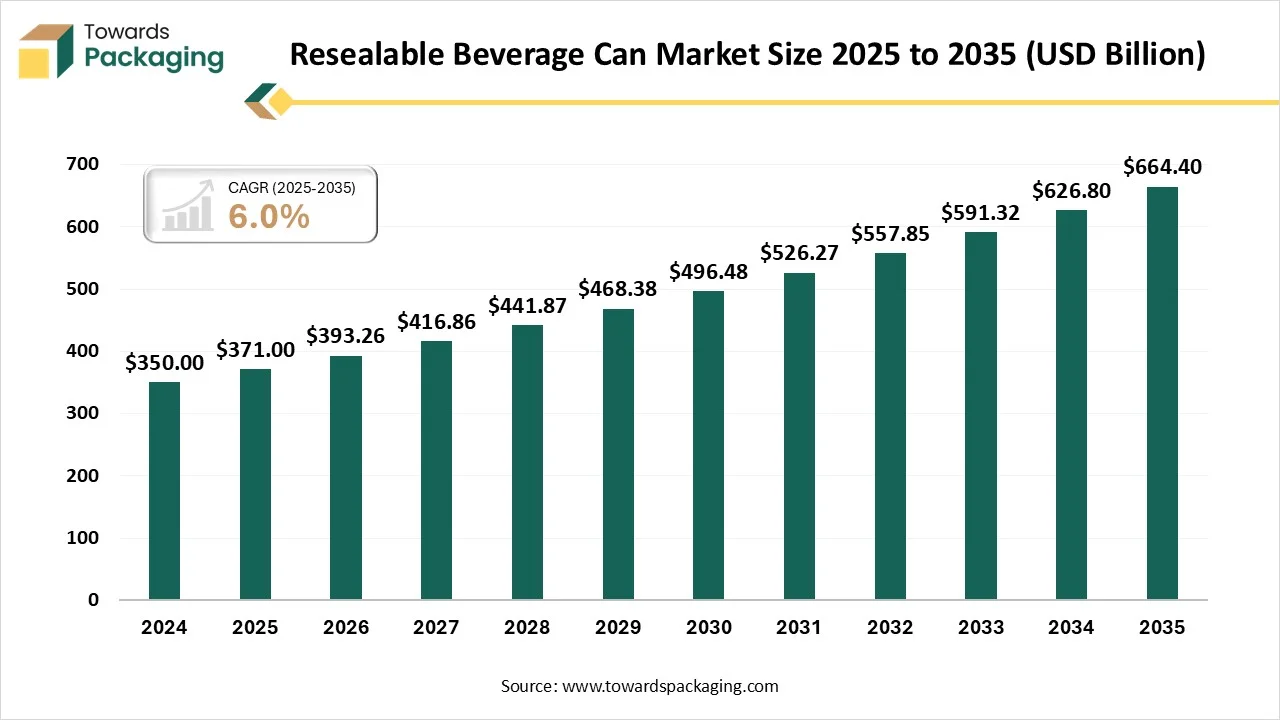

Ottawa, Feb. 12, 2026 (GLOBE NEWSWIRE) -- The global resealable beverage can market hit USD 371 billion in 2025, with current forecasts pointing to USD 664.40 billion by 2035, according to Towards Packaging, a sister firm of Precedence Research.

Request Research Report Built Around Your Goals: sales@towardspackaging.com

What is Meant by a Resealable Beverage Can?

A resealable beverage can is an innovative metal container featuring a reclosable lid or cap, designed to allow consumers to open, close, and store beverages multiple times while maintaining freshness and reducing spills. Unlike traditional single-use cans, these containers use mechanisms such as screw-on caps or sliding closures, making them suitable for multiple uses and providing a more portable, sustainable alternative to plastic bottles.

Get All the Details in Our Solutions - Access Report Sample: https://www.towardspackaging.com/download-sample/5938

Private Industry Investments for Resealable Beverage Cans:

- Xolution GmbH (€45 Million Equity Investment): Inventure Management provided €45 million to scale the production of the XO2.0 resealable lid system to reach a global capacity of over one billion units.

- Ball Corporation ($60 Million Expansion): Ball invested $60 million into its Sri City facility to advance production of sustainable aluminum solutions, including innovations in refillable and resealable formats.

- Crown Holdings (£150 Million UK Facility): Crown committed over £150 million to establish a massive new plant in Peterborough, focusing on high-capacity production for advanced metal packaging and sustainable closure technologies.

- Ardagh Metal Packaging ($600 Million PIPE): Private investors committed $600 million through a PIPE (Private Investment in Public Equity) to fund Ardagh’s global growth and its development of specialized, infinitely recyclable beverage ends.

- Canovation Private Funding: Canovation has secured private capital to commercialize its CanReseal technology, which converts standard aluminum cans into threaded, airtight resealable containers.

- Inventages Venture Capital Support: As an early-stage backer, Inventages invested in resealable technology startups to address the market demand for portion control and portability in the beverage industry.

Join now to access the latest packaging in industry segmentation insights with our Annual Membership: https://www.towardspackaging.com/get-an-annual-membership

What Are the Latest Key Trends in the Resealable Beverage Can Market?

- Advanced Sealing Technology: New designs feature aluminum and plastic, tamper-evident lids that preserve carbonation, such as those introduced by Augusta Label and Sav-Ty, which is a major trend in the market.

- Sustainability and Circular Economy: Aluminum remains the top choice due to its high recyclability, with brands focusing on reducing environmental footprints through increased recycled content, increasing the demand.

- Convenience for On-the-Go Consumption: Resealable, wide-mouth cans are increasingly used for Ready-to-Drink (RTD) coffee, tea, and functional beverages, which is a growing trend in the market.

What is the Potential Growth Rate of The Resealable Beverage Can Industry?

The market growth is driven by several factors, including rising consumer demand for sustainable, portable, and convenient on-the-go packaging due to increasing environmental concerns and heightened awareness, which in turn drives the demand for reusable and sustainable materials, thereby fueling market expansion. Other key growth factors are a shift toward infinitely recyclable aluminum, advancements in closure technology that maintain freshness and safety, and the growth of premium beverage materials.

Regional Analysis:

Who is the leader in the Resealable Beverage Can Market?

Asia Pacific dominates the market in 2025, riven by rising demand for sustainable, convenient, on-the-go packaging for RTD coffee, tea, and functional drinks, which fuels the growth of the market. Increased adoption of aluminum for recyclability, "lightweighting" for environmental benefits, and advanced, innovative closures to ensure product freshness are the major growth drivers in the market in the region.

China Resealable Beverage Can Market Growth Trends

The Chinese market is experiencing robust growth, driven by rising demand for convenience, urbanization, and premiumization in the beverage sector. The other key trends include the adoption of innovative, sustainable resealable closures to enhance brand differentiation and meet consumer preferences for on-the-go functionality, which drives the market's growth. The market is witnessing a shift towards innovative, resealable closure systems to increase brand appeal and consumer convenience, although this increases production costs, which further influences the growth of the market.

How is North America experiencing significant growth in the Resealable Beverage Can Industry?

North America is expected to experience significant growth in the market in the forecast period, a strong shift toward sustainable, infinitely recyclable aluminum, increased adoption of specialized resealable ends for product freshness, and innovative designs for enhanced consumer portability fuel the growth and expansion of the market. The market is heavily driven by consumer demand for eco-friendly, lightweight, and resealable packaging.

U.S. Resealable Beverage Can Market Trends

The U.S. market is driven by increasing demand for on-the-go convenience, sustainability, and the premiumization of ready-to-drink (RTD) beverages, including craft beers and energy drinks, which increases the demand aligning with the growth of the market. Resealable cans offer enhanced branding opportunities for premium, high-quality, or specialized beverages, making them a preferred choice for craft brands seeking to stand out, which increases growth in the country.

More Insights of Towards Packaging:

- Europe Food Packaging Market Size and Segments Outlook (2026–2035)

- Shrink Label Films Market Size, Trends and Competitive Landscape (2026–2035)

- U.S. Rigid Packaging Market Size, Trends and Segments (2026–2035)

- North America Packaging Market Size, Trends and Regional Analysis (2026–2035)

- North America Plastic Packaging Market Size, Trends and Segments (2026–2035)

- Biopolymer Packaging Market Size, Trends and Segments (2026–2035)

- Next-Generation Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Recycled Materials Packaging Solutions Market Size and Segments Outlook (2026–2035)

- Commercial Printing Market Size, Trends and Competitive Landscape (2026–2035)

- Packaging Films Market Size and Segments Outlook (2026–2035)

- Contract Packaging and Fulfilment Services Market Size, Trends and Regional Analysis (2026–2035)

- Canada Pharmaceutical Packaging Market Size, Trends and Segments (2026–2035)

- South Korea Cosmetic Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Germany Flexible Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- U.S. Cosmetic Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- U.S. Pharmaceutical Packaging Market Size, Trends and Regional Analysis (2026–2035)

- U.S. Glass Packaging Market Size and Segments Outlook (2026–2035)

- Flexible Packaging Adhesive Market Size, Trends and Regional Analysis (2026–2035)

- France Pharmaceutical Packaging Market Size, Trends and Regional Analysis (2026–2035)

- Japan Packaging Machinery Market Size, Trends and Competitive Landscape (2026–2035)

Segment Outlook

Product Type Insight

How Did Standard Resealable Cans Segment Dominate the Resealable Beverage Can Market?

The standard resealable cans segment dominated the market in 2025, as they are designed to allow multiple openings and closings without significant loss of carbonation or product integrity. These formats are increasingly used in carbonated beverages, energy drinks, and functional drinks, where consumers prefer portability and portion control. Their growth is driven by on-the-go consumption trends, sustainability advantages over plastic bottles, and innovation in aluminum can design that supports convenience while maintaining recyclability and brand differentiation in competitive beverage markets.

The amper-evident/safety resealable cans segment is projected to grow at the fastest rate in the market over the forecast period, as they incorporate safety features that provide visual or mechanical indicators if the product has been opened or compromised. These are particularly important in premium beverages, nutraceutical drinks, and sensitive liquid food products where product safety and consumer trust are critical.

Increasing regulatory scrutiny around packaging integrity and rising consumer awareness regarding product safety are accelerating the adoption of such advanced resealable formats, especially in developed beverage markets.

Closure / Resealing Mechanism Type Insight

How did the Screw-Top Resealable Lids Segment Dominate the Resealable Beverage Can Market?

The screw-top resealable lids segment dominated the market in 2025, as it provides a secure and repeatable sealing mechanism, helping maintain carbonation and preventing leakage after opening. These closures are favored for functional beverages, sports drinks, and specialty beverages that are consumed over extended periods. The technology supports premiumization strategies, as brands leverage innovative closures to enhance user experience.

Advances in lightweight metal closures and integrated lid designs continue to improve performance while maintaining compatibility with existing can production systems.

The snap-on or gasket-based reseals segment is projected to grow at the fastest rate in the market for the forecast period, as it uses pressure-fit mechanisms or flexible sealing materials to create an airtight closure. These systems are valued for their simplicity, lower cost compared to threaded systems, and suitability for mass-market beverage products.

As beverage companies aim to balance convenience with cost efficiency, this closure type is gaining traction. Improved gasket materials and sealing technologies are enhancing durability and beverage freshness retention across multiple openings.

End-User Industry Insight

Which End-User Industry Segment Dominates the Resealable Beverage Can Market?

The beverage packaging segment dominated the market in 2025, driven by growing demand for portable, resealable, and environmentally sustainable packaging formats. Carbonated drinks, ready-to-drink teas, coffees, energy drinks, and alcoholic beverages are increasingly using resealable cans to differentiate products and improve consumer convenience. Rising urban lifestyles and single-serve consumption patterns are major drivers, while the recyclability of aluminum continues to support the segment’s sustainability appeal.

The food products segment is projected to grow at the fastest rate in the market for the forecast period, particularly for liquid or semi-liquid foods such as soups, dairy-based drinks, and nutritional supplements. Resealability enhances shelf-life management after opening and reduces food waste. As consumers seek convenient storage and portion control, food manufacturers are exploring metal resealable formats as alternatives to rigid plastic or glass packaging. Technological advancements in sealing and internal coatings are making this segment more commercially viable.

Elevate your packaging strategy with Towards Packaging. Enhance efficiency and achieve superior results - schedule a call today: https://www.towardspackaging.com/schedule-meeting

Recent Breakthroughs in the Resealable Beverage Can Industry

In December 2025, East Coast Canning is partnering with Swedish company Meadow to introduce the MEADOW KAPSUL resealable aluminum can system in Australia and New Zealand, offering multi-use and refillable packaging options. This system utilizes aluminum's recyclability to support reuse and aims to replace single-use plastics in various product categories beyond traditional beverages.

Top Companies in the Resealable Beverage Can Market & Their Offerings:

- Ball Corporation: They produce the Alumi-Tek® bottle, a lightweight aluminum container that combines the portability of a bottle with the cooling properties of a can via a re-closable screw cap.

- Crown Holdings, Inc.: Crown offers various resealable solutions, including the Crown Bolt technology, which utilizes a specialized rotating tab to open and re-seal the beverage.

- Ardagh Group S.A.: Ardagh manufactures aluminum bottles with threaded necks that allow for a resealable cap, often used for premium beer and energy drink brands.

- Can-Pack Group / CANPACK S.A.: They provide a diverse range of aluminum beverage cans and have collaborated on innovative end designs that focus on ease of opening and temporary re-closure.

- Silgan Holdings, Inc.: While focused heavily on food, Silgan provides metal beverage containers and specialized ends designed to maintain product freshness and carbonation.

- CPMC Holdings Limited: This company manufactures high-quality two-piece and three-piece aluminum cans with advanced easy-open ends tailored for the beverage and liquid food markets.

- Showa Denko K.K. (Resonac): They specialize in the production of aluminum cans and bottles, including "bottle-can" formats that feature a resealable cap for consumer convenience.

Segment Covered in the Report

By Product Type

- Standard Resealable Cans

- Aluminum resealable beverage cans

- Single-use resealable cans

- Mass-market beverage cans

- Specialty Resealable Cans

- Premium printed resealable cans

- Slim & sleek resealable cans

- Custom-branded cans

- Tamper-Evident / Safety Resealable Cans

- Child-resistant resealable cans

- Tamper-proof seal integrated cans

- Multi-layer safety seal cans

- Large-Format Resealable Cans (>301 ml)

- Energy drink, large cans

- Beer & RTD large cans

- Multi-serve beverage cans

- Small-Format Resealable Cans (<200 ml)

- Shot-size energy drinks

- Functional beverage cans

- Sample & trial cans

By Closure / Resealing Mechanism

- Screw-Top Resealable Lids

- Plastic screw caps

- Aluminum screw caps

- Hybrid screw-cap systems

- Snap-On or Gasket-Based Reseals

- Silicone gasket reseals

- Snap-fit lids

- Pressure-seal reseals

- Twist-Top Reseals

- Quarter-turn twist tops

- Lock-and-twist mechanisms

- Tab-Integrated Resealable Ends

- Pull-tab with reseal slider

- Integrated tab-lock systems

By End-User Industry

- Beverages

- Carbonated soft drinks

- Beer & alcoholic beverages

- Energy drinks

- Ready-to-drink (RTD) beverages

- Food Products

- Ready-to-eat meals

- Liquid soups & broths

- Meal replacement products

- Personal Care & Others

- Liquid supplements

- Specialty liquid personal care products

- Niche household liquids

By Region

- North America:

- U.S.

- Canada

- Mexico

- Rest of North America

- South America:

- Brazil

- Argentina

- Rest of South America

- Europe:

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

- Asia Pacific:

- China

- Taiwan

- India

- Japan

- Australia and New Zealand,

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

- MEA:

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA

Invest in Our Premium Strategic Solution: https://www.towardspackaging.com/checkout/5938

Request Research Report Built Around Your Goals: sales@towardspackaging.com

About Us

Towards Packaging is a global consulting and market intelligence firm specializing in strategic research across key packaging segments including sustainable, flexible, smart, biodegradable, and recycled packaging. We empower businesses with actionable insights, trend analysis, and data-driven strategies. Our experienced consultants use advanced research methodologies to help companies of all sizes navigate market shifts, identify growth opportunities, and stay competitive in the global packaging industry.

Stay Connected with Towards Packaging:

- Find us on Social Platforms: LinkedIn | Twitter | Instagram | Threads

- Subscribe to Our Newsletter: Towards Sustainable Packaging

- Visit Towards Packaging for In-depth Market Insights: Towards Packaging

- Read Our Printed Chronicle: Packaging Web Wire

- Get ahead of the trends – follow us for exclusive insights and industry updates:

Pinterest | Medium | Tumblr | Hashnode | Bloglovin | LinkedIn – Packaging Web Wire | Globbook | Substack | Bluesky | Justdial | Crunchbase | TrustPilot | Bizcommunity - Contact: APAC: +91 9356 9282 04 | Europe: +44 778 256 0738 | North America: +1 8044 4193 44

Our Trusted Data Partners

Precedence Research | Towards Healthcare | Towards Food and Beverages | Towards Chemical and Materials | Healthcare Webwire | Packaging Webwire | Precedence Research Insights

Towards Packaging Releases Its Latest Insight - Check It Out:

- U.S. Seed Packaging Market Size and Segments Outlook (2026–2035)

- Europe Pharmaceutical Glass Packaging Market Size, Trends and Segments (2026–2035)

- Uncoated Paperboard For Luxury Packaging Market Size, Trends, Share, Trends, Segments, and Regional Insights (NA, EU, APAC, LA, MEA)

- Consumer Packaged Goods (CPG) Market Size, Trends and Competitive Landscape (2026–2035)

- Automotive Parts Packaging Market Size, Trends, Share and Innovations

- North America Yogurt, Cheese & Meat FFS Packaging Market Size, Trends and Segments (2026–2035)

- U.S. Black Rigid Plastic Packaging Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Refillable Packaging Market Size, Trends and Regional Analysis (2026–2035)

- Dairy Product Packaging Market Size and Segments Outlook (2026–2035)

- Middle East Seafood Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Middle East Packaging Machinery Market Size, Trends and Segments (2026–2035)

- Biofoam Packaging Market Size and Segments Outlook (2026–2035)

- Sanitary Food and Beverage Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Ready-to-Use Pharmaceutical Packaging Market Size and Segments Outlook (2026–2035)

- Europe Glass Prefilled Syringes And Glass Vials Packaging Equipment Market Size, Trends and Competitive Landscape (2026–2035)

- Asia Pacific Food Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Europe Pharmaceutical Packaging Market Size, Trends and Segments (2026–2035)

- North America Pharmaceutical Packaging Market Size and Segments Outlook (2026–2035)

- North America Post-Consumer Recycled Plastics Food Packaging Market Size, Trends and Regional Analysis (2026–2035)

- Europe Transfer Molded Pulp Packaging Market Size, Trends and Regional Analysis (2026–2035)